Abstract

Over the past years, the strength of the Kenyan Shilling to the global reserve currency, i.e., the US Dollar, has been quickly dwindling. About Fifteen years ago, a dollar traded for approximately Kshs. 87. Currently, however, a dollar is trading for Kshs. 140.45. Such inflation has, in turn, affected various sectors, such as domestic taxation, pricing of essential commodities, cost of living, and the real estate/investment industry. The ripple effect is that, as a consequence, this has affected the country's foreign direct investment market, which encompasses various areas of financial infrastructure which the country relies on.

This research aims to analyze and focus on the relationship of the Kenyan Shilling vis-a-vis the foreign investment infrastructure in the country.

Introduction

When it comes to a currency state, a single currency accepted as legal money in the state or country is issued. This currency is considered a domestic currency from the perspective of the currency state region, while all other currencies are considered foreign currencies.

The local currency is more than just local. It comes with so much or so little value with only far-reaching implications and/or ramifications for society.

Economical as it may heavily appear to sound, the currency remains to wear the face and shape of a socio- economical fact. It is crucial to note that currency also takes various variations across the globe in the name of local and foreign currencies. Such variation has heavily impacted the nature and structure of governments and their policies and financial decisions, e.g., foreign investment. It may therefore be okay to state that as the democratic society may be, with its structure of governance and the rule of law, it all narrows down to 'monetary economics.'

For a society to nourish, there ought to be a steady flow of its local currency and demand of the same only in equal or more significant measure domestically and internationally. Any downward change in the growth of a country's local currency produces a corresponding but lagging change in the country's national income rate. As a result, the monetary/financial change shall be felt in the inflation of the same currency. When central banks determine their monetary policies, one important factor to consider is the national currency's value on the international market. The interest rate on your loans, investment returns, the cost of local goods, and other factors may be influenced directly or indirectly by currency values.

The development of foreign investment infrastructure in a country is chiefly contributed to by Foreign Direct Investment (FDI) which connotes the investment pattern where an investing country uses capital for the production and operation in the host country to own part of management rights, which is one of the primary forms of modern capital internationalization. Developing countries heavily rely on FDI as a source of capital. Most African countries depend on the development of foreign investment infrastructure to boost their economic welfare. Foreign investment infrastructure, therefore, plays the pivotal role of boosting the monetary muscle of a country by filling the gap between domestic savings and investments while mobilizing the necessary resources to achieve the Sustainable Development Goals (SDGs).

Kenyan Shilling, Foreign Direct Investment and Economic Growth in Kenya

The Kenyan Shilling (KES) has been the official currency of the Republic of Kenya. It was first introduced in 1966 as a replacement for the East African Shilling. Due to the stability of the currency, Kenya had been a magnet for foreign direct investment within the East African region in 1960s and 1970s due to land reforms and import substitution strategies towards industrialization. However, the performance of the country has been negatively affected in the past decades. Nevertheless, a wide range of Transnational Corporations (TNCs) have been present in the country and the role of FDI has been especially present in the dynamic sectors of the economy. The Investment Policy Review of Kenya, as compiled by the United Nations Conference on Trade and Development (UNCTAD) has provided some focus areas for further enhancement of FDI in Kenya. These include:

● The manufacturing of basic consumer goods and industrial inputs for the regional market.

● The development of Kenya into a regional services hub.

● Agri-business activities.

● Diversification of activities in export processing zones.

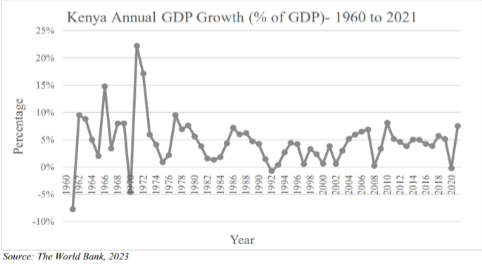

According to the World Bank, Kenya’s economic growth “has been driven by private consumption and public spending, crowding out private investment and dampening net exports”. The following graph emphasizes on the annual GDP growth experienced by Kenya over the years:

Kenyan Shilling, Foreign Direct Investment and Economic Growth in Kenya

There exist various legislations in Kenya that regulate and govern the foreign investment infrastructure in Kenya, which in turn promotes Foreign Direct Investment. They include but are not limited to:

a) The Foreign Investment Protection Act No. 35 of 1964;

b) The Investment Promotion Act CAP 485B;

c) The Public-Private Partnerships Act No. 14 of 2021;

d) The Investment Disputes Convention Act CAP 522;

e) The Industrial Property Act No. 3 of 2001; and

f) The Treaty Establishing the East African Community.

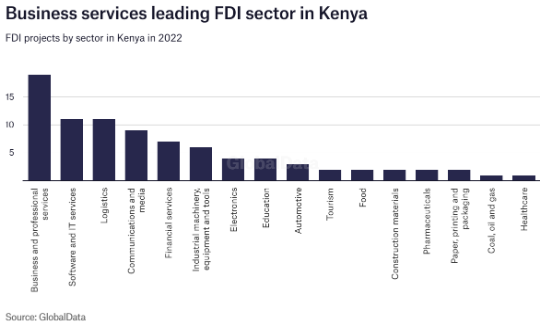

FDI in Kenya

FDI in Kenya remains comparatively weak if the country's economic size and local infrastructural development are to be considered. Despite this aspect, even today, Kenya remains one of the largest FDI recipients within the African region. The country's investment inflows are primarily from developed nations and some developing economies such as China and India. Chiefly, Kenya attracts most of its FDI-registered projects from China. Over the past years, however, the co-dependency between Kenya, the United Kingdom, and the United States in terms of contribution to local investment has been at a declining level.

The recent economic developments in Kenya

Since the start of 2023, Kenya has faced a foreign exchange crunch, with US dollar reserves falling to their lowest in the past eight years. While many factors are being attributed to this occurrence, the main reason is the repayment of loans to bilateral and commercial lenders, especially since the global pandemic sparked an economic crisis. Due to the economic crisis, many listed companies have also resorted to trading US dollars among themselves, breaking the Central Bank of Kenya (CBK) law and causing a parallel exchange rate. This has further resulted in lenders buying and selling the currency above the official CBK rate, adding to the crisis.

In 2022, foreign investors pulled out $170 million from the Kenyan stock market while citing escalating global risks. This resulted in the plunging of shares up to 28%, causing a loss of $6.37 billion to investors. This stock market crisis was not the end of it all since the country then experienced rising inflation, droughts, and food insecurity, and eventually caused a rise in fuel prices due to Russia's invasion of Ukraine. Eventually, the cost of living in the country has increased beyond relief.

In the past five years, the Kenyan shilling has lost 37% of its value against the dollar, which has resulted in a limited supply of dollars, and affecting the livelihoods of millions. However, the country is expected to experience improved trade dynamics over this year and the next.

Impact of a depreciated local currency on Foreign Direct Investment (FDI)

We have already determined that the local currency depreciation shrinks a country's investment climate, and the FDI flows from the foreign country to a host country. The depreciated local currency has always endured being one product of financial weakness which repels prospects of developing foreign investment infrastructure. Countries that attract the highest amount of foreign direct investment in the world rarely have to depreciate their currency to attract these investments. On the converse, most countries that attract the highest foreign direct investment include Singapore, the USA, the UK, the Netherlands, Ireland, Brazil, China, Germany, and India. These are just but some of the countries that have attempted to establish an economic hegemony within their geo-economic regions and have been rewarded by securing many foreign investment opportunities. Within the African Union (AU), some countries like Rwanda, Ghana, and Egypt have managed to create and maintain a stable and steady financial muscle, attracting many foreign investment opportunities that have boosted their economies.

Arguably, there is a possibility of having a depreciated local currency and attracting foreign investment opportunities/foreign direct investment. Such a result can only occur when and where certain factors exist and in the proper proportions. They include but are not limited to;

a) GDP: A country’s GDP should be relatively high to attract foreign investment. It is the most commonly used indicator of economic performance of any country in the world;

b) Foreign policy and laws: How a country treats foreigners socially and legally determines a great deal how much foreign investment a country gets;

c) Stability and security: The state of a country's physical security and political stability matters in attracting foreign investors.

d) Human resources: The quality and quantity of a country’s market determines how much foreign investment it receives.

e) Industrialization and technological advancements: A technologically advanced country is more likely to attract more FDI than a country with poor technology and industrialization.

f) Exchange and inflation rates: Exchange and interest rates define the potential of an economy. They could be high or low, stable or volatile. It is essential to know these rates as many important decisions can only be taken with knowledge of these rates. Currency devaluation and revaluation fall into this category.

g) Profitability: The general profitability rate peculiar to prospective investment affects how much capital inflows the country should expect.

h) The existing portion of FDI: Since FDI is a scarce and limited commodity, knowing the portion of FDI a country holds compared to the total FDI available worldwide will help determine if the country is ready for more capital inflow or capital repatriation.

Promising signs for Kenya’s Foreign Direct Investment (FDI) landscape

Finance and insurance make up the majority of foreign direct investment (FDI) in Kenya (around 33%), followed by information and communication (16.1%), wholesale and retail (15.4%), and manufacturing industries (14.8%). Kenya has historically been one of Africa's largest recipients of FDI. According to the World Economic Forum's 2020 Country Competitiveness Report, Kenya was the best African nation for its human capital quality and the accessibility of research and innovation.

In July 2021, the UK announced £132m new investments in Kenya. This move's main aim was to " create new jobs and unlocking new opportunities for UK and Kenyan businesses by strengthening the relationship between Nairobi and the City of London."

In March 2023, Business Insider revealed that the Economic Partnership Agreement (EPA), which governs the relationship between the UK and Kenya, is believed to be worth $10 billion. The Kenyan Ministry of Investments, Trade and Industry thereafter released a statement saying, "The EPA provides a good framework for strengthening the strategic cooperation between Kenya and the UK in the areas of trade, investment, research, innovation, and development at both government and private sector level."

Kenya is also a regional leader in clean energy development, wherein more than 80% of on-grid electricity is derived from renewable sources. In February 2023, Kenya's cabinet approved removing the September 2021 moratorium on new power purchase agreements (PPA), which boosts foreign investment in this sector.

Therefore, despite the recent unrest in Kenya and the declining foreign investment figures, the domestic policy changes and the UK-Kenya partnership upholds a promising national FDI strategy.

Conclusion

Building a stable and attractive foreign investment climate takes much perseverance, resilience, and patience. However, it is worth mentioning that Kenya already has a well-established financial and telecommunications infrastructure and fiscal and non-fiscal incentives for foreign investors. Nonetheless, significant hurdles to investment remain, most notably the country's jerry-built infrastructure, critical talent shortages, political, social, and ethnic divisions, ineffective rule of law, and corruption.

Therefore, it is highly recommendable that the Kenyan Government fast-track its implementation measures toward reforming the country's local policies that attract FDI. Its strategic location within East Africa plays an advantage to it in terms of being a suitable regional economic hub. It is also essential that much focus is put on strengthening the financial ties it has with foreign investors who remain to play a quintessential role in the stability of the country's monetary economics.

About the Author

Trevor Omondi Oduor, Advocate of the High Court of Kenya.

Muskaan Aggarwal is a 5th year B.A.L.L.B student at Jindal Global Law School, Sonipat.

Editorial Team

Managing Editor: Naman Anand

Editors-in-Chief: Abeer Tiwari & Muskaan Singh

Senior Editor: Aribba Siddique

Associate Editor: Muskaan Aggarwal

Junior Editor: Kanishka Bhukya

Recent Comments