1. Introduction

A long-term power supply agreement known as a Power Purchase Agreement (PPA) is reached directly (bilaterally) between a buyer (an electrical consumer) and a supplier (plant operator). This agreement guarantees the provision of electricity at a specified cost or by similar monetary compensation. It hasbecome a way of keeping these promises in all kinds of circumstances, including the financial chaos brought on by the Covid-19 outbreak.

The 2021 United Nations Climate Change Conference, often known as COP26, helped to raise interest in this topic. Countries were requested to present aggressive 2030 greenhouse gas emission reduction targets that would put them on the road to reach net zero emissions by the middle of the century at COP26, the 2021 UN Climate Change Conference, which just took place in Glasgow. These promises have already been made by numerous nations. Governmental net zero commitments to date, according to the International Energy Agency (IEA), account forover 70% of world GDP and carbon dioxide emissions. In addition, in November 2022, India’sLong Term Low Emissions Development Strategy (LTS) was presented to the UNFCCC. It outlines India’s goals and course of action for reaching its goal of becoming a net zero emitter by 2070.

With a focus on emissions from the power sector, many businesses are developing goals and action plans to assist in meeting these obligations. Companies that own assets for producing electricity are generally investing in renewable energy sources in an effort to reduce the carbon intensity of their power output over time. While this is happening, electrical end users are thinking of ways to cut their Scope 2 emissions (i.e., those indirect emissions resulting from the purchased/acquired electricity, heat, stream and cooling).

By using less energy and increasing energy efficiency, scope 2 emissions can be decreased. However, businesses are also looking into ways to either buy renewable energy directly to replace the electricity they use from the grid or buy the environmental benefits associated with renewable power production to offset the emissions associated with their electricity use as long as electricity use persists—or even increases in tandem with the growing electrification of vehicle fleets and other equipment. Due to this, interest in private power purchase agreements has increased (PPAs).

Private PPAs are contracts between a generator (the seller) and a private party customer (the buyer) for the purchase of electricity. They can beclassified as virtual or physical PPAs. This essay focuses on Virtual PPAs and how they can influence the upcoming power society.

2. Virtual Power Purchase Agreements

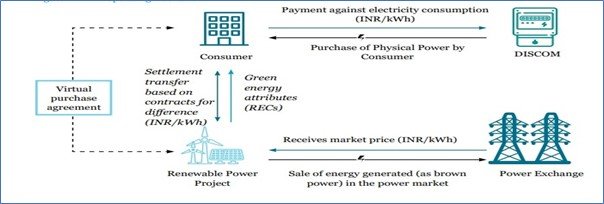

A virtual power purchase (VPPA), also referred to as a financial or synthetic PPA, is a long-term agreement, usually lasting 10 to 20 years, or a bilateral agreement that permits a financial transaction between a producer of renewable energy and a consumer, with distribution companies handling the actual transaction (DISCOM). Although the electricity is traded on the specific market by a “contract for differences,” the buyer ensures, as in a direct PPA, that the developer receives a fixed price for their energy. In the “contract for differences” settlement, the fixed price and the fluctuating market price are compared.

Under the VPPA, the electricity producer sells its electricity at the going rate on the power exchange (such as the Indian Energy Exchange (IEX), Power Exchange India Ltd. (PXIL), etc.). In exchange for a predetermined VPPA contract price known as thestrike price, the consumer only receives the renewable energy attribute (green energy credits) connected with the traded electricity. Thereal pricing agreement between the consumer and the power producer, however, is based on the difference between the strike price and the wholesale market rate.

Here, the difference between the market price and the fixed price would determine who would make up the shortfall: if the market price is lower than the fixed price, the consumer will make up the difference; if the fixed price is lower than the market price, the generator will make up the shortfall. In a one-way VPPA, the consumer is solely responsible for paying the generator back if the market price is less than the strike price. These agreements give parties the ability to evaluate the risks, deal with the electrical market’s price volatility, choose a settlement mechanism, and support green certification for consumers.

Commercial and industrial (C&I) users are more likely to embrace two-way VPPAs, given the advantages (Two-way VPPA is when the difference between the fixed price and the market price, is what determines which party ends up compensating for the difference. In case the fixed price is greater than the market price, it is the consumer that compensates. In the opposite situation, the generator compensates). Since the power is added directly to the grid, they assist C&I consumers in receiving green energy benefits without having to set up the power projects themselves or enter into agreements with differentprojects to provide renewable energy to nationwide enterprise projects.

2.1 Importance of VPPA’s

Businesses worldwide want to have a strong renewable energy plan in place and focus on sustainable business practices that reduce their carbon footprint, which is driving up the demand for clean energy. Reliance on renewable energy sources also helps corporations’ reputations since stakeholders and customers see them as companies that care about society and its welfare. The objectives are often met by obtaining power in the most conventional manner possible through power purchase agreements (PPAs). In third-party PPAs, the off-taker purchases the renewable system’s electric yield for a predetermined period at a predetermined price from the developer, who owns, runs and maintains the renewable (PV/Wind/Hybrid) system. The agreement enables the off-taker to acquire dependable electricity at a reasonable price.

While PPAs are unquestionably the most widely used tools for achieving sustainability goals, virtual PPA or synthetic PPA (VPPA) is becoming more common. There are many benefits connected to VPPAs. Regardless of where each organization’s facilities are situated, a VPPA can enable groups to combine their carbon footprints into a single renewable energy project under a single agreement. It also assures the solar project a fixed price for its output. As long as a company continues to buy electricity from the utility and also engages in a VPPA for renewable energy, VPPAs don’t even disrupt the traditional electricity supply for that company. Organizations get significant financial advantages over time by engaging in a VPPA and locking in a low fixed energy price. Additionally, because Renewal Energy Certificates (RECs) are transferred as part of the agreement, organisations are able to make valid claims for the usage of clean energy and carbon reduction.

According toBloomberg New Energy Finance’s research, virtual PPAs accounted for more than 80% of PPA contracts executed in the US in 2019. The introduction of VPPAs has accelerated the transition to more sustainable energy sources. Additionally, this offers a fantastic chance to create renewable energy projects in, more recently, developing countries like India.

VPPAs are attracting an expanding range of businesses and sectors. The main winners, in the beginning, were tech corporations with high energy use connected to data centres. But lately, businesses in the healthcare, media, manufacturing, retail, pharmaceutical, food and beverage, agricultural, and even oil and gas industries have all benefited from the VPPA model.

The VPPA is ideally suited to link highly energy-demanding facilities with renewable energy, such as sizable data centres and manufacturing plants, but they are also a viable alternative if you have numerous smaller energy-demanding facilities. Chains of retail stores or service businesses, for instance, can pool their energy usage across all of their sites and link to renewable energy through a VPPA.

For instance,Duke Energy Renewables and a Fortune 100 corporation that is likewise committed to the RE100 have signed a VPPA. The Frontier I wind farm owned by the VPPA is located in Oklahoma and produces 75 MW of wind energy. Thiswind-rich region generates 50% of the company’s yearly electricity needs in addition to local jobs and much-needed revenue for farmers and rural communities.

3. VPPA’s in India

While the US has welcomed VPPAs, with big corporations signing over 80% of PPA contracts as Virtual PPAs to satisfy their RE needs, India is yet to fully jump on the sustainability bandwagon. The introduction of theElectricity (Promoting Renewable Energy Through Green Energy Open Access) Rules by the Indian Ministry of Power on June 6, 2022, marked a significant shift in favour of VPPAs. These regulations cover “Waste-to-Energy” facilities (facilities responsible for combusting waste, to produce electricity) as well as the primary sources of RE, such as wind and solar energy.

The following are the main problems in a conventional setting of power trading based on PPAs with utilities:

(i) Demand-based issues

(ii) Regulatory concerns

(iii) Financial shortcomings

The VPPAs aim to offer a balanced and comprehensive energy solution to address these problems. This is due to the fact that India’s cost of energy production is lower than that of many other nations, a fact that could positively impact India’s status as an international distributor of renewable energy byoffering a compromise in cost benefits between finance developers and buyers while allowing consumers to access RE globally.

According to a report by WWF-India recently published titled “Virtual Power Purchase Agreement (VPPA) for C&I consumers in India,” the total estimated demand for VPPAs in India by 2030 could be as high as 104 GW, which could contribute to meeting 27% of the country’s remaining target of 500 GW by that year. The VPPAs provide numerous strategic benefits that enable them to fill current market gaps without jeopardising their ongoing partnership with DISCOMS (Distribution Companies) for procurement. This paper offers advice on the specific roles of stakeholders and a way forward that would make it possible toimplement VPPAs in India, in addition to outlining the advantages afforded by VPPAs in that country.

In India, VPPAs can assist customers in overcoming infrastructure limitations, a lack of interstate power scheduling, and the policy risk associated with open access. States where these obstacles have up till now hampered the expansion of the open-access renewable market, including Haryana, Punjab, and West Bengal, among others.

However, the road to the execution of VPPA in India has not been a smooth one, particularly when you take into account the jurisdictional problems related to the derivative nature of VPPA. The same has since been discussed:

3.1 The derivative nature of VPPA

Technically, VPPAs fit the definition of a derivative because they are set up as bilateral contracts under IFRS accounting standards, meaning they are not traded on any platform. Since it is a financial derivative, the virtual powerpurchase agreement (VPPA) can be exchanged on a stock exchange.

Through an amendment made in 2000 to theSecurities Law Amendment Act of 1999, the term “derivatives” is now included in the definition of “securities.” Derivatives is a term that encompasses

(A) A security derived from a dated instrument, share, loan, whether secured or unsecured, risk instrument or any other form of security.

(B) A contract which derived its value from the prices, or index of prices, of underlining securities.

Section 18A of theSecurities Contracts (Regulation) Act of 1956 (SCRA) was added by the aforementioned amendment, and it now states that derivative contracts are only lawful if they are resolved on a stock exchange.

Since the Central Electricity Regulatory Commission (CERC) does not recognise derivative contracts and the Securities and Exchange Board of India (SEBI) is the proper body to deal with such contracts, the derivative nature of the contract made the jurisdiction the main obstacle to adoption in India. However, the core of the agreement necessitates a clasped approach.

In itsreport, the committee established by the Ministry of Power to study the issue in 2019 recommended that CERC regulate all Ready Delivery Contracts and Non-Transferable Specific Delivery (NTSD) on the power exchanges. In addition, SEBI would be responsible for commodities derivatives in the power market that are not NTSD Contracts as defined under the Securities Contract (Regulations) Act.

The proposed arrangement was approved by the Supreme Court on October 7, 2021, so opening the Indian market for power derivatives. According to theSupreme Court’s order and an understanding between SEBI and CERC, CERC will henceforth oversee all forward contracts based on physical delivery, while SEBI will oversee financial derivatives. Therefore, under certain restrictions and conditions, CERC would govern:

- The ready delivery contracts and Non-Transferable Specific Delivery (NTSD).

- TheSecurities Contracts (Regulation) Act of 1956 (SCRA) contracts for electricity entered into by participants in the power exchanges that are registered under the CERC (Power Market) Regulations of 2010.

SEBI would regulate:

- Commodity Derivatives in electricity other than Non-Transferable Specific Delivery (NTSD).

- Contracts as defined in SCRA.

A strict and unambiguous set of rules would simplify the jurisdictional issue and enable the electricity market participant to put in placean efficient complaint process and registration system.

4. The Bilateral Transfer of ‘Green’ Attributes or REC’s from the Project Developer to the Consumer

Currently, one of the major regulatory issues for VPPAs relates to the bilateral transfer of ‘green’ attributes of RECs from project developer to consumer, which is currently not allowed in India.

The energy generated by RE generators may be considered as having two components electricity component (brown component) and an environmental attribute (green component). The cost of electricity generation equivalent to using conventional energy sources and the cost of environmental attributes make up the total cost of electricity generation from RE sources. Environmental characteristics can be traded using RECs.

In 2010, CERC introduced Renewable Energy Certificate (REC), a market-based instrument to trade green power. Once a developer registers the project under REC regulation, they receive RECs for the actual units generated, which can be further traded in power exchange. However, one of the downsides is that these RECs cannot be assigned back to their original project.

The price of REC is determined by the market, but to safeguard the interest of various stakeholders, CERC introduced forbearance (ceiling) and floor prices, which were determined periodically. CERC had also formulated procedures for the accreditation, registration, issuance, and redemption of RECs. However, the REC mechanism has now been redesigned by the Ministry of Power (approved on September 29, 2021). Some of the major changes include:

- The validity of REC would be perpetual, i.e., until it is sold

- Traders and bilateral transactions of RECs have now been allowed

- RECs can be issued to required entities (including DISCOMs and open access consumers) beyond their RPO compliance. This will assist them in achieving their internal sustainability and RE procurement goals.

It should be kept in mind that RECs issued in VPPAs have the following two requisites:

1. They must be issued directly to the consumer with whom VPPA has been signed.

2. They must be linked back to the original project as corporate consumers will need to declare the additional renewable power installation which occurred owing to their power demand.

In the current scenario, all RECs in the Indian market are traded through power exchanges. However, the CERC does allow bilateral retention of RECs for compliance with renewable purchase obligations by Captive Generating Plants (CGP), which are power plants providing an energy user with a localised source of power. Other than CGP, bilateral procurement of RECs is not available as an option for one-one arrangements between a consumer and a dedicated RE supplier. This mandatory requirement of procuring RECs through power exchange puts a significant additional burden on the corporate RE consumer due to the following implications:

- Increased transaction costs (due to GST being levied on RECs)

- Exposure to the irregular market supply of RECs

- Risk of sudden price escalation in instances when the REC supply falls below the demand

Therefore, allowing corporate RE consumers to procure RECs through bilateral transactions in instances of one-to-one arrangements between a consumer and a dedicated RE project developer would be beneficial. It would not only make it easier for the consumers to claim the source and track RECs but also provide certainty to the supplier in cases of long-term PPAs and VPPAs, which will make it easier for them to secure funding for RE projects.

5. The Rise of VPPAs Internationally

While India strives to deal with the emerging issues related to VPPAs, many companies across the world have taken the help of VPPA’s for the promotion of renewable energy. Some examples include:

- A subsidiary of NextEra Energy Resources, LLC and an American multinational chemical company named DuPont has signed a VPPA with ageneration capacity of 135 megawatts of new wind energy in Texas.

- A 12-year Virtual Power Purchase Agreement (VPPA) has been signed by Huhtamaki, a significant global supplier of environmentally friendly packaging solutions and a division of NextEra Energy Resources, LLC. The largest producer of wind and solar energy in the world is NextEra Energy Resources. About 30% of Huhtamaki’s current electricity needs in the US and Mexico, where the company has 18 manufacturing facilities, are met by the 42-megawatt renewable energy agreement.

- For the development of a future wind and storage project in Texas, the United States, Merck, a leading science and technology company, has signed a12-year, off-site virtual power purchase agreement (VPPA) with Enel Green Power.

- Matrix Renewables, the TPG Rise-backed global renewable energy platform, andCentrica Energy Marketing & Trading today announced the signing of a new virtual PPA.

- A 10-year, fully renewable Pan-European VPPA for 270 GWh/year of renewable energy was signed, according to Johnson & Johnson. The VPPA will significantly advance Johnson & Johnson’s climate goal of100% renewable electricity globally by 2025 by assisting the company in reaching the equivalent of 100% renewable electricity in Europe by 2023.

- The EU Cross-BorderVPPA has been a focus of the negotiations for a while.

- Bukchon Seomo Wind Power,a wind farm in Bukchon-ri, Jeju, and Amorepacific, signed Korea’s first VPPA.

Facebook has teamed up with the clean energy company CleanMax, based in Mumbai, for a 32 MW wind power project that will be constructed in southern Karnataka. Around 50% of the project’s energy generation capacity has already been commissioned and is producing electricity. Facebook will buy electricity off the grid usingenvironmental attribute certificates (EACs) or carbon credits, with CleanMax managing the project ownership and management. Therefore, firms have started contracting VPPAs in India as a sign of potential exponential growth in the coming years. However, legal guidelines and clearances still face a grey nature, clarity to which is looked forward.

6. Way Forward

In particular, VPPAs could significantly contribute to India’s recently announcedNDC goal of procuring 50% of the total installed capacity for electric power from non-fossil fuel sources by 2030. A very encouraging sign that the Indian government is open to novel approaches to the procurement of renewable energy is the announcement by the government of the introduction of a green tariff policy and thenotification of thePromoting Renewable Energy Through Green Energy Open Access Rules, 2022. The time is right for India to investigate fresh options, such as VPPAs. Recent modifications to the REC mechanism also permit the trading of RECs on a bilateral basis, which should make the development of VPPAs easier. The sale of bundled RECs through bespoke arrangements, as Indian corporate buyers looking to enter into VPPAs may seek or need, is not expressly addressed by the new regulations. [1]

While the NLDC (the designated central agency in this regard) may be able to issue RECs to eligible entities (subject to restrictions and qualifications) in accordance with the 2022 REC Regulations, such centralised issuance may not be sufficient in and of itself to make VPPAs viable. Commercially, for both parties to fully benefit from a VPPA, RECs must be transferred by eligible entities (or directly issued by the central agency) to private/corporate counterparties. In light of these requirements, the REC framework could therefore be more clearly stated.

In this context, the Indian REC registry’s website posted a detailed implementation procedure for the 2022 REC Regulations in September of last year. Such a procedure mandates that before submitting a trade request to the central agency, electricity traders must have back-to-back agreements with both buyers and sellers. As a result, it’s possible that in the future, bundled REC transfers will be specifically provided for.

The 2021 Power Market Regulations, along with applicable changes made to the 2022 REC Regulations, may in the future expressly provide for the delivery of RECs (as opposed to the delivery of electricity). For instance, a delivery-based forward contract for the sole purchase of RECs could be a part of the overall contractual structure of a hybrid VPPA. The 2021 Power Market Regulations contemplate bilateral transactions in respect of OTC contracts related to the physical delivery of electricity anyway. Additionally, under such regulations, the definition of “contract” includes agreements between sellers and buyers for the sale and purchase of RECs. Therefore, such forward contracts or purchase agreements involving RECs might be feasible if RECs are regarded as “electricity” by the appropriate authorities and exchanged by sellers and buyers through electricity traders (and not via power exchanges).

Furthermore, companies in a wide range of industries are being held accountable to meet aggressive renewable energy targets not only by regulators but also by their clients and investors. The selection of the tools that will help a company achieve its sustainability and renewable energy goals requires careful consideration of a variety of different factors. Although VPPAs canbe a potent acceleration tool for achieving those objectives, they inevitably carry risks that must be carefully assessed and allocated.

A strict and unambiguous set of rules would simplify the jurisdictional and REC issue and give the electricity market an efficient registration and dispute resolution system. In the long run, Indian legislators must allow VPPAs in order to aid businesses in achieving their objectives of 100% RE sustainability.

Disclaimer

This publication does not deal with every important topic or change in law and is not intended to be relied upon as a substitute for legal or other advice that may be relevant to the reader’s specific circumstances. If you have found this publication of interest and would like to know more or wish to obtain legal advice relevant to your circumstances, please contact the individual as listed.

About the Author

Ms. Simran Sharma is a Legal Associate at HSA Advocates.

Editorial Team

Managing Editor: Naman Anand

Editors-in-Chief: Jhalak Srivastav and Muskaan Singh

Senior Editor: Naman Jain

Associate Editor: Muskaan Aggarwal

Junior Editor: Kaushiki Singh

Endnote

[1] In most markets with an EAC scheme in place, attribute certificates can be acquired “bundled” (the electricity and the certificates are sold and delivered together) or can be purchased “unbundled” (the certificates are purchased separately, independent of any specific purchase of physical electricity). Another popular scheme for unbundled EACs is the International Renewable Energy Certificates (“I-RECs”) program. The Green Certificate Company Limited (“GCC”) issues I-RECs in India, which can be traded internationally. Thus, India-based gencos can transfer I-RECs to entities outside India.

Preferred Method of Citation

Simran Sharma, “Virtual Power Purchase Agreements: Introduction, Current Stance, and Way Forward” (IJPIEL, 17 February 2023)

<https://ijpiel.com/index.php/2023/02/17/virtual-power-purchase-agreements-introduction-current-stance-and-way-forward/>

Recent Comments