Abstract

Cash flow is central to construction projects and is enabled primarily through timely payments to all project stakeholders. Payment delays are endemic in the construction industry worldwide and cause cash flow problems, disputes, bankruptcies, cost overruns, and delays in the construction project.

Various countries across the world have formulated legislative and contractual solutions to enable timely payments in construction projects. Legislative solutions are like enacting the Construction Law/Construction Contract Act/Security of Payment Act which provides certain rights to contractors and subcontractors in case of delays in payment and fast interim binding dispute resolution methodology during the project’s currency. Contractual solutions are about adopting a standardized balanced contract of the correct type, which give equitable rights to all contractual stakeholders and a fast interim binding dispute adjudication mechanism.

India has a vast infrastructure drive and faces tremendous cost overruns, delays and disputes in construction projects. However, the country has not explored and adopted any legislative solutions that have worked successfully elsewhere. This blog post provides an overview of these solutions, which have been successful in other countries facing similar problems as India in its construction industry, with food for thought about whether these solutions will be successful for the Indian construction industry.

Keywords: Construction Projects, Payment Delays, Disputes, Construction Law

A Brief Background on the Genesis of Construction Law

In the early 1990s, Britain was facing an acute recession. The construction industry was the first to suffer the effects of the recession and last to recover. The significant impact of the recession on Britain’s construction industry was an environment of “bid low claim high” wherein contractors and consultants sought to obtain contracts at all costs, often at a loss, expecting the profits to recoup through claims as the project progresses. This approach resulted in many disputes, ultimately resulting in delays and cost escalations in construction projects.[1]

At this time, in 1994, Sir Michael Latham, an MP in British Parliament, brought out a report written with joint inputs from government departments, private employer agencies, contractors’ associations and various other representatives of the construction industry, titled “Constructing the Team.”[2] Apart from the other recommendations, this report advocated a Construction Law for Britain intending to have “balanced contracts,” enable timely payments to all stakeholders of the construction project and have a faster resolution of disputes. It is widely acknowledged that implementing significant recommendations of this report, including enactment of Construction law, helped transform the landscape of Britain’s construction industry.[3]

In the following, the author shall discuss the lifeline of construction projects –– cash flow –– and shall scrutinize the significant outcomes of delayed payments.

Lifeline of a Construction Project – Cash Flow

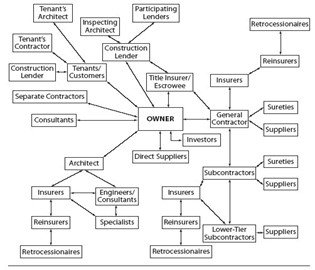

Cash flow is the central lifeline of a construction project. [4] Cash flow enables that correct and timely payments are made to all project stakeholders. Timely payments assume greater significance in construction projects due to long gestation periods and a prominent number of stakeholders having contractual, “quasi-contractual,” and non-contractual relationships with each other as shown in Image 1.

Delays in payments are endemic in construction projects all over the world. [5] European commission’s report on Payment Behaviour in Business-to-Business transactions, 2018, reported that the construction industry is the most affected by payment delays, with 65% of stakeholders having experienced delays. [6] Extensive research across the world has shown that payment delays lead to four significant outcomes:

- Cash flow problem,

- Increase in disputes,

- Insolvencies and bankruptcy,

- Cost overruns and project delays

These outcomes are accentuated manifold in times of recession.

In the following, the author shall briefly discuss the “Construction Law” of the UK by describing its salient aspects and impact on the construction industry.

The Construction Law of United Kingdom: UK Housing Grant, Regeneration and Construction Act (HGCRA) 1996

One of the outcomes of the report by Sir Michael Latham [7] was the enactment of the UK’s Housing Grant, Regeneration and Construction Law (HGCRA) 1996, also called the “Construction Law.” [8] Salient aspects of the Act include:

- Classifying construction contracts as a separate category of contracts.

- Mandatory provisions in all construction contracts of a time-bound payment schedule (submission of the bill followed by time-bound acceptance/partial acceptance/ rejection with reasons) and time-bound payment of the accepted amount specified in the contract.

- Right of contractor and subcontractor to act on delayed payments as follows:

- Claim interest.

- Suspension /partial suspension performance if the delay is beyond a specific limit with the right to claim additional costs.

- Termination of the contract if excessive delay with the right to claim additional and lost profit.

- Banning conditional payments (pay if paid and pay when paid) clauses in contracts led to delay in payments down the contracting chain.

- Specifying default periods of payment if not specified in the contract.

- Legal right to refer any dispute anytime during the pendency of the contract to 28 days past the “interim binding” statutory adjudication. This can be appealed against through arbitration/litigation, but only after implementing the adjudicator’s decision.

The net effect of HGCRA and other measures taken by the UK is a 30% rise in productivity and a massive drop in disputes referred to arbitration and litigation. During the period 2002-2012, out of 15000 cases referred to 28-day interim binding adjudication, less than 300 were appealed in arbitration/litigation. [9]

In the following, the author shall discuss the Security of Payment Act – the legislation aimed to ensure timely payments in construction projects – and its variants developed by various countries.

The Enabler of Timely Payments: Security of Payment (SOP) Act

This legislation primarily aimed at enabling timely payments to stakeholders in construction projects is called the “Security of Payment (SOP) Act.” Various countries have made their legislations like the SOP Act on the same lines as the HGCRA in the UK.

The HGCR Act, 1996 [10] requires the payment to be made to the payee within 5 days of the due date and in case of reduced payment a ‘pay less’ notice is required to be given by the payer within 7 days. Based on a similar framework, The Construction Contract Act (CCA) 2002 (New Zealand) [11] and Western Australia Construction Contract Act (CCA) 2004 [12] have been formulated. These require that the response to the claim of payment should be made by the contractor (called payment schedule) and payment should be made within 20 days and 10 business days, respectively.

In Singapore, The Singapore Building and Construction Industry Security of Payment Act 2004 [13] necessitates the payment response to payment claim to be made within 7 days and payment within 21 days and similarly, the Construction Lien Act 2017, Ontario [14] asks for payment to the contractor to be made within 28 days of payment claim and to the subcontractor within 7 days of contractor receiving the payment.

Malaysia is the only developing country to have a proper act to deal with SOP Legislations. Under the Construction Industry Payment and Adjudication Act 2012 [15] the payment response to a payment claim can only be done within 10 days.

Through these few examples we can summarise the SOP Acts legislated by various countries for the Construction Industry.

Coming to dispute resolution for any inconsistency that arises, these legislations have specific dispute resolution clauses. These acts specify the rights and the time that is to be taken for adjudication of disputes in an ideal situation.

Taking up the same acts as mentioned above, the HGCRA 1996 UK, provides for a right to refer any payment related dispute to adjudication anytime during the currency of the contract. There can be an interim binding adjudication decision given within 28 days. The CCA, 2002 of New Zealand has the same provision as given in the HGCRA 1996. For Western Australia, the same right as under the HGCRA 1996 is provided with the only difference of adjudication period. The Western Australia Construction Contract Act (CCA) 2004 makes 10 business days as the limit to make an interim binding adjudication. For Singapore, Ontario and Malaysia, adjudication decision is to be made within 14, 30 and 45 working days, respectively.

Studies conducted by various institutes and Government committees have shown that all these SOP legislations have had a moderate to a high positive impact on the construction industry. This impact was in terms of productivity, cost escalation, time delays and disputes, and even behavioral changes that created better relationships among stakeholders. [16]

In the following, the author shall describe the USA’s variant of the SOP Act alongside discussing its Construction Law.

The state-wise Legislations Model of the USA: A Unique Variant

While the USA does not have a Federal construction law, it has state-wise legislation to ensure timely payments in construction projects. These are of three types:

1. Prompt Payment Acts (PPA):[17] These are similar to SOP Acts, which give legal rights to the contractor to suspend performance for non/delayed payment and resort to expedited arbitration, irrespective of what the contract lays down. The most famous of these legislations is the New York PPA, 2003.

2. Mechanic’s Liens:[18] Mechanic’s lien is involuntary security granted by law to all construction project participants for labour or material provided for the project/property. Involuntary security means that a lien exists irrespective of the owner’s consent, implying that anyone who has not been paid his dues for his contribution to the construction project(contractor/subcontractor/supplier/labour) can file a lien that gives him a right to the construction property. This lien attaches to land records and the liability transfers with subsequent purchases. Mechanic’s lien is practised in all 50 states of the USA since 1790.

Though this is a powerful tool available to contractors/subcontractors to get their pending dues, it is highly laborious. Mechanic’s liens have encouraged resolving payment-related disputes in construction projects through ADRMs (Alternate Dispute Resolution Mechanisms), and Employers are taking a proactive role in enabling timely payments to stakeholders.

3. Miller’s Act in 1934:[19] The US Federal Govt legislated Miller’s Act in 1934. This Act requires all main contractors bidding on Govt projects to submit Payment Guarantee Bonds to the Employer, which guarantees payment to all subcontractors and suppliers for the unpaid balance dues at the end of the project. Most states in the USA have enacted similar Acts for their state-funded projects called “Little Miller’s Act.” Release of balance dues to the subcontractor/supplier/labour from the payment bonds also obviates Mechanic’s lien’s filing.

In the following, the author shall briefly describe China’s Construction Law alongside its revision of 2011.

Construction Law Model 2.0: China’s Construction Law

In contrast to this, PRC enacted its Construction Law in 1997, which was amended in 2011. [20] It was to regulate the quality of work, check illegal subcontracting and ensure the project’s financial viability sanctioned by local authorities. The law states its purpose as “Tightening supervision over and administration of construction activities, maintaining the order of construction market, ensuring construction quality and safety and promoting the sound development of construction industry.” The law deals with construction permits, business qualifications for undertaking construction projects, subletting and undertaking construction contracts, supervision over a construction project, safety control, quality control and legal liabilities.

Some exciting and unique provisions of China’s Construction Law as revised in 2011 are:

- Project management, advisory services and consultancy services are included in the definition of construction works.

- All public-funded/finance projects must use standard contracts (FIDIC for contracts with international firms).

- Late interim payments will attract an interest penalty of two times the late payment at prevailing bank lending rates.

- Prohibition on subcontracting whole work.

- The main contractor and subcontractor are jointly liable to the owner for the subcontracted work. Joint liability represents a fundamental difference from the Common law rule of the Privity of contract.

In the following, the author shall discuss the models adopted by other countries for ensuring timely payment to stakeholders of construction projects.

Models Adopted by Other Countries for Timely Payments

Many other countries which have not enacted Construction law have tried to regulate payments and rights of contractors and enable fast resolution of disputes by contractual and administrative measures such as:

- Adoption of standard forms of contract such as FIDIC and NEC

- Mandating project bank accounts/escrow accounts for prompt payments to all parties [21]

- Mandating interim binding Dispute Avoidance and Adjudication Boards (DAAB) or Dispute Resolution Boards (DRB) in construction contracts

- Enabling effective conciliation and mediation, which are honoured by all parties

In the following, the author shall provide the final concluding comments by briefly discussing the future scenario of India’s construction law.

Conclusion: Overview of the Indian Scenario and the Future Way Forward

India is one of the few countries in the world with a considerable infrastructure budget. It neither has a standard contract form for construction nor a Construction law or any of the contractual/administrative measures listed above. Most construction contracts in India are “imbalanced” and heavily tilted in favour of the Employer. Many clauses about the rights of contractors, such as the right to suspend performance in case of non/delayed payment, have been excluded in all Indian construction contracts. The net effect of these imbalanced contracts coupled with a lack of specific legislation is a massive backlog of disputes in arbitration and litigation. [22] As an example, the average world value of construction disputes as per the 2020 Arcadis Global Construction Dispute Report is US$ 30.9 million, and the average time for resolution is 15 months. [23] However, in India, NHAI alone faces disputes in arbitration of US$ 10 billion with an average time of resolution of 7-8 years. Research conducted by the undersigned of 29 arbitration awards of Indian railways finalized between 2005-2009 showed that railways paid 25% of the original contract value as an interest component only due to delays in the dispute resolution process. [24]

Will enacting a Construction Law resolve some of the ills plaguing the Indian construction industry – delays in payments, cost and time overruns, and a colossal backlog of disputes? Or do we need only better implementation of existing laws? It may be worthwhile for NITI Aayog and the Law Commission of India to look into this aspect.

About the Author

Brigadier Amit Kathpalia is a senior management professional, Civil Engineer and an Army veteran with 36 years of experience in construction contract management, administration, handling legal and arbitration cases, security management, and disaster management. He is also a construction dispute resolution expert.

Editorial Team

Managing Editor: Naman Anand

Editors-in-Chief: Akanksha Goel & Aakaansha Arya

Senior Editor: Kanak Mishra

Associate Editor: Jhalak Srivastav

Junior Editor: Pushpit Singh

Preferred Method of Citation

Amit Kathpalia, “Does India need a Construction Law?” (IJPIEL, 6 May 2021)

<https://ijpiel.com/index.php/2021/05/04/does-india-need-a-construction-law/?et_fb=1&PageSpeed=off>

Endnotes

[1] M. Latham, Trust and Money: Interim report of the joint government-industry review of procurement arrangements in the UK construction industry (1993).

[2] M. Latham, Constructing the team: Final report of the government-industry review of procurement and contractual arrangements in the UK construction industry (1994).

[3] Construction Reports 1944-98 (eds. David Langford and Michael Murray, 2003).

[4] A. Supardi, H. Adnan, & M.F. Mohammad, Security of payment regime in the construction industry: Are Malaysian subcontractors ready?, 4(1) The Built Environ. & Human Rev. 122, 122-137 (2011).

[5] A.A. Aibinu & H.A. Odeyinka, Construction delays and their causative factors in Nigeria, 132(7) J. of Construction Eng’g Mgmt. 667, 667-677 (2006).

[6] J. Rzepecki et al., European Commission Report: Business to business transactions: A comparative analysis of legal measures vs soft law instruments for improving payment behaviour (2018).

[7] supra note 2.

[8] The Housing Grants, Construction and Regeneration Act, 1996(UK).

[9] Robert Gaitskell, Adjudication and its effect on other forms of dispute resolution (The UK experience), 105 Aus. Construction L. Newsletter 6, 6-16 (2005).

[10] The Housing Grants, Construction and Regeneration Act 1996,(UK).

[11] The Construction Contracts Act, 2002, New Zealand.

[12] The Construction Contracts Act, 2004, Western Australia.

[13] The Building and Construction Industry Security of Payment Act, 2004.

[14] The Construction Lien Act, 2017, Ontario.

[15] The Construction Industry Payment and Adjudication Act, 2012.

[16] L. Eugenie, Curing the ills of non-payment in the construction industry – the Singapore Experience, Meeting of the 8th Surveyors’ Congress (Kuala Lumpur, 2006); see also J Murray AM, Review of Security of Payments laws: Issues Paper, Australian Govt. (Feb. 2017), https://www.ag.gov.au/sites/default/files/2020-03/review_of_security_of_payments_laws_-_issues_paper.pdf; P. Kennedy et al., The Development of Statutory Adjudication in the UK and its Relationship with Construction Workload, Glasgow Caledon University (2010), https://www.gcu.ac.uk/media/gcalwebv2/ebe/content/COBRA%20Conference%20Paper%202010.pdf; P. Kennedy, Progress of Statutory Adjudication as a Means of Resolving Disputes in Construction in the United Kingdom, 132(3) J. of Professional Issues in Eng’g & Practice 236, 236-247 (2006); J. Rzepecka et al., European Commission Report: Business to business transactions: A comparative analysis of legal measures vs soft law instruments for improving payment behaviour (2018).

[17] The New York PPA, 2003.

[18] The Ohio Uniform Commercial Code, 2007; see also B. Brummit et al., State of Kansas Construction law Compendium, US Law (2017), https://www.uslaw.org/files/Compendiums2017/Construction17/Kansas_Construction_Compendium_2017.pdf.

[19] The Miller Act, 1935.

[20] The Construction Law of PRC, 1997; see Edwin H.W. Chan & Henry C.H. Suen, Dispute resolution management for international construction projects in China, 43(4) Mgmt. Decision 589, 589-602 (2005).

[21] R. Griffith, W.E. Lord, & J. Coggins, Project Bank Account – The Second Wave of Security of Payment, 22(3) J. of Fin. Mgmt. of Prop. & Construction 322, 322-338 (2017).

[22] Prashant Gupta, Rajat Gupta, & Thomas Netze, Building India: Accelerating Infrastructure Projects, McKinsey and Company (Aug. 2009), https://www.mckinsey.com/~/media/mckinsey/dotcom/client_service/Infrastructure/PDFs/01%20Building%20India.ashx.

[23] 2020 Global Construction Dispute Report, Arcadis (2020), https://www.arcadis.com/en/knowledge-hub/perspectives/middle-east/2020/global-construction-disputes-report-2020.

[24] A. Kathpalia, Cost Implications of Delays in Dispute Resolution in Indian Construction Contracts (Savitribhai Phule University, Pune, Daffodil International University, Dhaka, Chitkara University and NIPM, Oct. 2020).

well explained viewpoint .The main point from employer side here is that how to get job satisfactorily completed in spite of paying dues to the contractor?