Abstract

In recent years, the oil and gas sector has emerged as a focus point for private equity investment, owing to the simultaneous dynamics of fluctuating oil prices and changing regulatory environments. This blog dives into the subtle relationship between oil price volatility and private equity investment in India, providing a comprehensive study [backed/focusing on] [by] the country’s regulatory environment. As oil prices fluctuate sharply due to geopolitical tensions, market dynamics, and global economic upheavals, private equity firms are forced to reconsider their investment strategies, risk management measures and overall portfolio allocations. The Indian regulatory environment, with its set of challenges and opportunities, becomes a significant consideration during investment decisions. This blog intends to throw light on the complicated relationship between market volatility and investing behaviour by analysing historical data, case studies and the implications of regulatory measures. Finally, it aims to provide useful insights for investors, legislators, and stakeholders in the oil and gas sector, highlighting the importance of adaptable strategies that take into account both market realities and regulatory constraints. We hope that this research will contribute to a broader discussion on sustainable investment methods and the future of energy financing in India.

Introduction

-

The Indian Oil and Gas Sector: India is not just the 3rd largest energy and oil consumer in the world, but also the 4th largest importer of Liquefied Natural Gas (LNG). As the data reflects, India consumed approximately 40.3 MMT (Million Metric Ton) of petroleum products and 11.3 BCM (Billion Cubic Meters) of natural gas from April to May 2024, thereby marking a growth rate of about 2.4% and 3.66% respectively during the period. This demand ought to see a rapid increase, owing to the oil and natural gas sector enjoying a close nexus with the Indian energy demand; thereby making the industry a global hotspot for investment in the sector. The government has implemented many policies to meet the rising demand. It has permitted 100% foreign direct investment (FDI) in various sectors of the industry, including natural gas, petroleum products (except for petroleum refining by the Public Sector Undertaking, without any disinvestment or dilution of domestic equity in the existing PSUs), and refineries, among others via the automatic route. The FDI limit for public sector refining projects has been increased to 49%, with no disinvestment or erosion of domestic ownership in existing PSUs. Today, it attracts both domestic and foreign investment, as can be reflected through the presence of multinational corporations such as Reliance Industries Ltd. (RIL) and Cairn India. The business is expected to further attract approximately $25 billion in investment for exploration and production. India is already a refining hub, with 23 refineries and development is planned to attract foreign investment in export-oriented infrastructure such as product pipelines and export ports.

Source: India Brand Equity Foundation (IBEF)

-

Introduction to price volatility in the oil and gas sector: The huge demand for oil and gas across the globe has subjected the aforementioned to rapid fluctuations in the price, i.e., the price volatility of the oil and gas sector, which is composed of complex relationships between economic, political and geopolitical factors. This in turn creates a direct impact on the investment(s) and its allied decision-making prowess. This volatility is further fuelled by the regional disparities (majorly composed of the nature of regulations, the resilience of the oil and gas industry of the region and the state of the economy) concerning the price of the oil. The best example of this could be seen by drawing a comparative analysis between North America and the Middle East/Russia. The former responded to the hike in the shale oil production by rapidly adjusting their investments, and on the other hand, the latter responds in a ‘muted’ manner to such a volatility owing to various decision-making process and priorities.

-

Introduction to Private Equity and the oil and gas sector: Now these ‘investments’ essentially does not only come from the government or the allied organisations. With the dawn of the modern-era, the world is witnessing the rise in the Private Equity Industry. Private equity (PE) refers to ownership or interest in companies that are not publicly traded or listed. Private equity is a type of investment capital given by entities that buy stakes in private companies or take control of public enterprises with the goal of taking them private and delisting them from stock exchanges. Private equity can also originate from high-net-worth individuals seeking large profits. Institutional investors, such as pension funds and large private equity firms backed by accredited investors are both part of the private equity business. Because private equity invests directly – often to gain influence or control over a company’s operations – a significant capital outlay is necessary, resulting in deep-pocket firms dominating the market. This very PE has proved to be pivotal for the investment opportunities in the oil and gas sector across the country. Oil price volatility has a substantial impact on the financial performance of private equity businesses working in the oil and gas sector. As oil prices change, private equity firms confront greater uncertainty about their investments, which can prompt a variety of strategic approaches. High volatility frequently causes organizations to postpone investment choices due to the unpredictability of future returns, influencing capital allocation and overall financial performance. This uncertainty also leads to a greater capital cost, as lenders perceive increased risk, resulting in tighter financing conditions for private equity-backed projects. Furthermore, oil price shocks can affect portfolio businesses’ operational costs, reducing profit margins and influencing exit plans for PE investors.

The Economics of Oil and Gas Production:

Before enumerating and deliberating on the legal and regulatory regime circumnavigating the oil and gas sector, it is of paramount importance that we understand and analyse the trends in the Oil and Gas Sector, coupled with the economics of it.

This analysis is important for the functioning of this blog as it not just promotes the regulatory regime, i.e., status quo of the current market concerning the oil and gas sector, as it plays a pivotal role in influencing a myriad of factors, like that of resource allocation and investment decisions, the key with regard to price forecasting, a proper and in-depth analysis of an examination of the economic impact of the oil and gas sector on the national economies, and the novel aspect of a proper assessment with regard to the environmental and social impacts of the oil and gas industry.

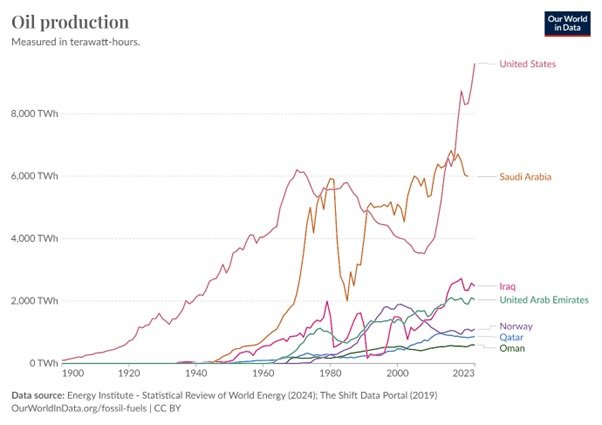

Fig. 01 (Oil Production by Country)

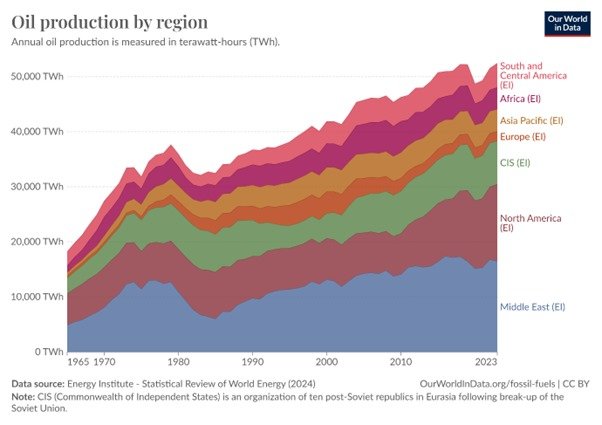

Fig. 02 (Oil Production by Region)

Upon a close analysis of Fig. 01, we understand that the graph depicts the trends with regard to the shifting dynamics of the oil production spread across the major players, i.e., the United States, Saudi Arabia, Iraq, the United Arab Emirates, Norway, Qatar, and Oman for the period of 1900 to 2023. The graph traces a clear hike in the oil production for all the aforementioned countries which therein concludes a sharp increase in the process of oil extraction and utilisation during the aforementioned timeframe. The trend perfectly aligns with the rapid industrialisation that took over the work during the World Wars. The graph highlights one of the important aspects of the ‘oil’ leadership across the globe. Although at present, the United States of America has occupied the ‘Pole Position’ with regard to oil production, one must not forget the role played by Saudi Arabia, which once was (even could be) one of the dominant players in the global oil production. The shift in the leadership reflected above clearly denotes the change in geopolitical leadership in the oil and gas sector.

On the other hand, when we analyse Fig. 02 (Oil Production by Region), we can draw a myriad of inferences. Such as:

-

-

A sharp rise in the global oil production across all the regions, which as mentioned above, was driven by rapid industrialisation and the expansion of various economies. This boost towards the economy is evident, taking into consideration the nature of oil, i.e., it being a dense carrier of energy, thereby instrumental in empowering economic growth;

-

-

-

Tilting towards the geopolitics, it is of paramount importance to highlight that the Middle East region has continued to solidify its position as one of the most important and crucial players of the global energy market. This essentially implies the high production levels from the Middle East, which in turn impacts the prices of the global oil prices and the aspects of energy security;

-

-

-

While the Middle East maintains its dominance, the graph shows that other regions are increasingly contributing to global oil production. North America, notably the United States, has seen significant expansion, thanks to technology advances in unconventional oil extraction, such as hydraulic fracturing and horizontal drilling. This breakthrough changed the global oil supply environment, reducing many countries’ reliance on Middle Eastern imports; and

-

-

The graph depicts oscillations in oil output for specific locations, which are frequently tied to geopolitical events and economic conditions. For example, production in the Commonwealth of Independent States (CIS) has been volatile as a result of political shifts and economic issues in the post-Soviet era. Similarly, the African continent has seen variable levels of production, impacted by factors such as political instability, varying investment climate and infrastructure growth.

The readers may wonder about the relevance of the aforementioned graphs to the subject of the blog. As mentioned previously, one cannot undertake the activity of understanding the aspect of private equity which essentially translates to private investments, without understanding the economics which play at the backdrop. Consequently, the following key aspects are required to be taken into consideration:

-

-

Demand Factors in the Oil and Gas Sector: While enumerating the economics of the Oil and Gas Sector, a continuous demand for the oil and gas (read: ever-expanding) to fuel their economy has been a constant trend. We would further analyse it through the following:

-

-

Economic Growth: The demand for oil and gas enjoys a rather close relationship with economic activities. With the expansion in the economies of various sovereigns, it is obvious that the economies of the aforementioned sovereigns would grow. Specific to India, the ideals of urbanisation and industrialisation have led to an unignorable increase in energy consumption. As per the projections of the International Energy Agency, Indian hunger for energy consumption, especially demand connected with oil ought to increase, owing to an increase in the transportation demand(s) and output from the industry. However, it is to be noted that the demand for the same could be elastic in nature, as India is still recovering from the plummeted oil consumption during the COVID-19 era.

-

-

Substitution Effect: With the growing international demand towards energy transition, and the key role played by India (especially the one where India continues to make strides in the renewable and new energy sector), the oil and gas sector, not just municipally, but at the international level has been made vulnerable to the substitution effect. The substitution effect occurs when the price of a product or service rises relative to other similar products, causing consumers to switch to less expensive alternatives. Therefore, with a rapid rise in alternative energy sources, the oil and gas market are prone towards a shift in mitigation of oil dependence. However, one must understand that this process of energy transition is rather gradual, and till that time, oil continues to remain a dominant player in the energy production market (read: short term).

-

-

-

-

Supply Factors in the Oil and Gas Sector: After analysing the demand side of the oil and gas sector, it is critical that we also understand the supply side of the oil and gas sector, and how exactly does it affect the oil and gas sector. However, one must understand before entering the specifics that the oil supply curve tends to be steep, i.e., leading to huge fluctuations in prices. The governing factors include:

-

-

-

-

Decisions related to production: One is not alien to extent of involvement of the Organisation of the Petroleum Exploring Countries (“OPEC”) in matters related to the oil production levels. As a result of the tug-of-war related to the production cuts or increase by the OPEC, price fluctuations hit a record high or low. The best example to understand this phenomenon would be production cuts during the periods of oversupply, which results in the stabilisation of prices, whereas, on the other hand, the increased production of the oil during the times of a hike in demand leading to a reduction in the price.

-

-

-

-

-

Advancement in Technology: Extraction technology plays a pivotal role in the Oil and Gas Sector. With the advancement in the technologies related to extraction of the oil, the supply of the oil has seen a sharp hike. With the commencement of hydraulic fracturing and horizontal drilling, the United States of America (“U.S.A./U.S.”) has seen a hike in the oil supply, particularly, the U.S. shale market. There is a high probability that with the advent in novel technologies, the oil prices are ought to hit the low bar, which in turn would impact the entire global oil market, including that of India.

-

-

-

-

Force Majeure Geopolitical Events: Geopolitical instability in oil-rich regions can disrupt supply lines and cause price increases. Conflicts in the Middle East, for example, sanctions imposed on countries such as Iran, has been seen to cause market uncertainty thereby driving-up oil prices. India, as a big oil importer, is especially sensitive to such interruptions, which can result in higher import expenditures and inflationary pressures.

-

Private Equity’s tryst with the Oil and Gas Sector:

As mentioned previously, the oil and gas sector continue to be a dominant player in the Indian energy sector, which essentially translates to accelerated economic growth. With the acceleration in the demand for energy, the need for heavy investment(s) has become ever-increasing. In order to cover the required investment(s), PE has upgraded itself as a dominant player in the market, especially in the oil and gas sector (read: both globally and in India). The PE funding not only assists in strengthening the infrastructure but also acts as a catalyst in upgraded production potential and in the exploration of newer oil reserves.

Shifting the focus towards the Indian oil and gas sector, one would find a rather unbalanced image for the same; it would be full of complexities around the regulatory regime, and the allied factors. This is because the Indian legal regulatory regime has its hands deep down in the PE sector for oil and gas. This in turn moulds investment strategies, risk mitigation and overall financial performance. This becomes further evident when Indian oil consumption is predicted to be doubled by 2045, when India intends on increasing its presence in the share of natural gas in her energy mix from 6.7% to 15% by 2030.

The detailed role of PE in the sector:

-

-

Infusion of the necessary capital: PE firms play a pivotal role in infusing the necessary capital to the oil and gas companies, specifically in the upstream and midstream segments. This funding translates into being the oxygen for the exploration activities, owing to their heavy capital-intensive and high-risk nature. Owing to this, the Government of India (“GoI”) allowed a 100% Foreign Direct Investment (“FDI”) in the upstream oil and gas projects, in order to provide leniency for the PE firms to invest in the exploration and production activities. As for the investment trends, the Department for Promotion of Industry and Internal Trade (“DPIIT”), the petroleum and natural gas sector was infused with the FDI of US$ 7.018 billion between April 2000 and March 2019. This trend highlights the piqued interest of the PE firms in the Indian Oil and Gas Sector. One of the added advantages for the PE firms is their long-term participation in the business as compared to the other investors, which enables the PE firms to infuse funds and provide support to the projects which are time-consuming.

-

-

-

Expertise in terms of Operations: Operational efficiencies are one of the important aspects, that the Public Sector Undertakings (PSUs) have lacked in. With the involvement of the PE firms in the game, the management and expertise that would be brought in would be a game-changer in the operational efficiency of the sector. It involves a proper optimisation of the production processes, enhancement of the supply chain management variable and improvement of the financial performance. Additionally, well-structured strategic guidance by the PE firms: market analysis, competitive positioning and risk management strategies would accelerate and ensure a positive turn for India in the operational expertise landscape.

-

-

Management of Risks: With the inherent risk of price volatility looming over the oil and gas sector, owing to demand and supply factors, or geopolitical tensions, the fear of loss with regard to investments is ever-present. However, the participation of PE firms, along with their risk management strategies, minimises the overall risk of losses. This is done majorly by hedging strategies (employment of future contracts and options, to hedge against price volatility, which stabilises cash flow, thereby protecting the clients against strong price movements) or by diversification, wherein the investment is spread across various projects and regions in the oil and gas assets, which in turn offers protection against localised disruptions or price shocks.

India’s Dance with the Oil and Gas Sector and the Glass Shoe of Private Equity:

The Indian Oil and Gas Sector presents a complex interlinked picture between the state-owned enterprises and the private players. India is heavily reliant on its imports with regard to crude oil, where 85% of the crude oil is imported to meet the growing demands for this sector; not to forget that it is the 4th largest LNG importer, refiner, and automobile market. However, to reduce the dependence on imports, and provide a hike in domestic production, the Indian government has taken various steps such as collaboration with various state-owned companies, with Oil and Natural Gas Corporation (“ONGC”) being the frontrunner.

ONGC’s success with regard to the production of crude oil from the novel deep-sea project, in the Krishna-Godavari (KG) basin block KG-DWN-98/2 has proved to be a huge shift for the country’s oil and gas production. According to Hardeep Singh Puri, Union Minister for Petroleum, this project is expected to increase current national oil and gas production by 7% each. While, according to an ONGC release, the 98/2 project is expected to increase the company’s overall oil and gas production by 11% and 15%, respectively.

ONGC’s success with regard to the production of crude oil from the novel deep-sea project, in the Krishna-Godavari (KG) basin block KG-DWN-98/2 has proved to be a huge shift for the country’s oil and gas production. According to Hardeep Singh Puri, Union Minister for Petroleum, this project is expected to increase current national oil and gas production by 7% each. While, according to an ONGC release, the 98/2 project is expected to increase the company’s overall oil and gas production by 11% and 15%, respectively.

However, it has not been that easy with regard to the PE investments and the Indian Oil and Gas Sector. The regulatory regime and the allied aspects have responded in a negative manner in certain cases:

-

-

The tense case of ONGC Videsh and International Ventures: ONGC Videsh is the overseas branch of the ONGC, which has been moving forward with creating a stable market for India’s energy security by engaging in international exploration and production opportunities. However, the road to recognition has not been that easy. In 2022, when ONGC Videsh transcended its plan to acquire stakes in oil fields in Africa (when ONGC Videsh had signed a definitive binding agreements with FAR Senegal RSSD SA and other major players) and the Middle East to diversify its portfolio and maximise India’s position for energy security, a high price-fluctuation was seen in the oil prices. Owing to the high oil prices in the year 2022, issues pertaining to oversupply and geopolitical tensions crept their way into the plans, and as a result, there was a sharp decline in the price of oil. This fiasco of oil price fluctuation had an adverse impact on the PE investment firms, i.e., the PE firms, which had held the hands of ONGC Videsh faced the demon for safe and secure flow of financing and increased volatility in terms of managing risk in the sector. The high oil price volatility raised eyebrows with regard to the long-term feasibility and viability of the aforementioned acquisition (a 13.6667% participating interest in the Exploitation Area and a 15% participating interest in the Exploration Area under the RSSD) which in turn scared the investors to pool in additional capital for the same.

As for the analysis part, we see that owing to the variation in the global oil supply, specifically from the U.S. Shale producers, the oil price volatility hit the ‘perceived’ value of the international assets. Additionally, due to the presence of ambiguity with regard to the oil prices, the PE firms were unable to prove their investment decisions, which in turn led to them carefully re-assessing their position of investment(s) in providing capital to international projects.

-

-

Hindustan Petroleum Corporation Limited (HPCL) and its Refinery Expansion: HPCL in the year 2022, in order to improve its position in the oil and gas market, and to cater to the ever-growing energy demand in the country, had announced to increase its refinery capacity. However, the announcement faced a lot of turbulence, especially during the years 2022-2023, owing to the oil prices being subject to constant fluctuations and volatility. At the commencement of the announcement, the high prices at that time led to the organisation eyeing the increase in the refining margins, but with the drop in the oil prices globally, the question of profitability (read: losses) for the expansion of the refinery started looming over the corporation.

This dicey situation led to the PE investment firms (like the International Finance Corporation, Blackstone Group, Warburg Pincus, Carlyle Group, HPCL-Mittal Energy Limited), which had invested in the HPCL’s refinery expansion plans to be left with crumbs as their returns owing to the steep reduction in the oil prices when they were promised loaf/loaves of bread. These price fluctuations led to the re-assessment of their investment strategies, wherein certain firms fixated to withdraw their capital from the said project or even decided to delay their funding for the said project. The volatile nature of oil in terms of price sensitivity led to a low confidence level for the investors in HPCL.

The case studies from 2022 to 2024 demonstrate the major impact of oil price volatility on private equity investments in India’s oil and gas sector. Geopolitical concerns, market factors, and strategic shifts have all had a negative impact on private equity organizations. As the global energy sector evolves, private equity investors must develop strong risk management techniques and remain adaptable to changing market situations.

Challenges for the Indian Oil and Gas Sector:

As has been established before the Indian oil and gas business is an important part of the country’s economy, ensuring energy security and promoting economic progress. As one of the world’s top oil consumers, India confronts enormous hurdles in meeting its energy needs, particularly in light of shifting oil prices and changing regulatory frameworks. PE has developed as an important source of finance for this industry; however, PE firms face several hurdles that have a direct impact on their investment strategy and overall performance in the Indian oil and gas industry:

-

Oil Price Volatility: As mentioned, time again, oil price volatility is an inalienable factor while determining the structure of the oil and gas markets in India (or globally), especially, when the power/decision-making is left in the hands of a select few. It is these fluctuations, which cause an evident effect on the revenue streams and profitability. In the case of a highly volatile oil and gas market, there exists certain ambiguities with regard to the future returns on the investments made by the PE firms. Thereby, causing a hiccup with regard to their (PE firms) investment, leading to a delay or even withdrawal of the investments. It is because of these delays that the development of certain important projects is put on a stake. The best noted example could be the viability (economic) of certain projects when the low oil prices prompt cancellations or even delays in exploration and production activities.

PE firms often at times employ mitigation techniques, in order to minimise the risk(s) associated with the price volatility in the oil and gas sector, including of hedging techniques (like future contracts and options trading), which again come with their own costs and complexities, with the effectiveness of the strategies dependant on the market conditions.

-

Uncertainty in the Regulatory Framework: The complexities with regard to the regulations in the Indian Oil and Gas Sector are not a novel discovery. The best example of the same could be the Hydrocarbon Exploration and Licensing Policy (“ HELP ”), which was introduced by the government in the year 2016. The ambitions of HELP focusing on providing a liberalised oil and gas sector and a flowing investment, fell flat, owing to the complexities with regard to revenue sharing, marketing freedom and environmental clearances, thereby leading to huge uncertainties for the present and potential investors (read: PE firms) in the market. Additionally, with the introduction of the Goods and Services Tax (“GST”) in the country, the Oil and Gas sector has taken a huge blow, in terms of regulations. The hues and cries of including the oil and gas sector under the purview of the GST are making the investors doubtful as the Companies, on the other hand, point out that non-inclusion in the indirect tax levy has resulted in a lopsided scenario for the upstream oil and gas sector, as procurement of important goods and services as inputs is subject to GST, whereas output is not. “Multiple tax regimes apply to different parts of the value chain,” as reported.

-

Concerns with regard to Environmental and Social Governance (ESG) in the country: The regulatory regime related to the environment has witnessed a striking change over the years. With the global stage set to transform its dependence from non-renewable energy sources to renewable energy sources, especially with the increasing demand for sustainable development and climate change mitigation techniques, problems for the Indian Oil and Gas sector have increased multi-fold. Although one cannot negate the need and importance of sustainable development and climate change mitigation, these regulations have added additional compliance costs, wherein the PE firms have been mandated to follow the regulations in their portfolio companies and have forced the timeline for the projects to be extended. Additionally, these regulations have forced the oil and gas companies to pitch in money towards cleaner technologies and allied practices. The Limited Partners (LPs; A limited partner is an investor who contributes capital to a private equity fund in exchange for a portion of its profits.) have now been vehemently coercing the inclusion of the ESG strategies utilised by the PE firms in their investment strategies. This trend involves private equity businesses assessing the environmental impact of their investments and developing risk mitigation methods for climate change and sustainability. Failure to address these concerns can lead to reputational damage and decreased investor interest.

-

The issue of “Illiquidity” and Capital Choke: The complicated and often time-consuming regulatory framework is a major cause of illiquidity. The complicated process of getting environmental permits, land purchase approvals, and other statutory permissions causes significant time delays and increases expenses. The uncertainty around project deadlines discourages long-term investments and impedes the smooth flow of cash. Furthermore, the volatility of crude oil prices, which is a significant predictor of sector profitability, exacerbates liquidity concerns. Fluctuations in oil prices affect revenue creation, making financial planning and investment decisions difficult. The capital-intensive nature of the oil and gas business necessitates significant investments in exploration, production, and infrastructure development. While the Indian government has made attempts to encourage private sector participation, such as the Open Acreage Licensing Policy (OALP), the industry remains underfunded. The reluctance of domestic banks to give long-term financing to the sector due to perceived dangers, along with international investors’ limited enthusiasm for high-risk projects, has exacerbated capital limitations.

-

The (Un)settling Novel Technological Advancements: Technology is often regarded as a double-edged sword; it serves twin purposes; it can save the master wielding it and at the same time has the ability to sever the life of its master. The same principle is applicable with regard to the emergence of novel technologies in the Indian Oil and Gas Sector. The advent of unconventional resources, such as shale gas and tight oil, has hastened technical progress. Hydraulic fracturing and horizontal drilling techniques, combined with advances in data analytics, have opened large reserves that were previously believed uneconomic. However, these technologies pose environmental issues and require effective regulatory systems. Additionally, Cloud computing, the Internet of Things (IoT), and automation are being used to improve processes, lower costs, and increase safety. For example, IoT sensors can be placed in oil and gas fields to monitor equipment performance and detect anomalies in real time, allowing predictive maintenance and maximizing asset usage.

-

Political Risk Insurance (“PRI”), Private Equity, and the Indian Oil and Gas Sector: This concept shall be a bit more detailed and an elaborated concept, in comparison to the other ones; this is because of the complexities revolving around the same. As the name suggests, PRI serves as an important instrument for the PE investors, specifically in the energy sector, for it is haunted by the uncertainties in relation to political stability, regulatory changes, et. al. Before enumerating on the aspect of PRI, it is of paramount importance, that we also understand the term ‘political risk.’ Political risk refers to the possibility of lower investment returns as a result of a country’s political upheaval or instability. This can take many forms, including government asset seizures, changes in regulatory systems, political violence, and corruption. For private equity investors, particularly in emerging nations such as India, these risks can have a substantial influence on investment viability and profitability.

According to a report by the Multilateral Investment Guarantee Agency (MIGA), political risk is a major barrier to foreign direct investment (FDI) in low- and lower-middle-income nations, where the impression of instability can lead to fewer capital inflows. While India’s general investment climate has improved, obstacles still exist, particularly in areas significantly influenced by government policies and geopolitical considerations. Political risk insurance is intended to reduce the negative impact of political risks on investments. PRI boosts investor trust and encourages capital flow into high-risk markets by insuring against specific risks such as expropriation, political violence, and contract breaches. The World Bank’s MIGA emphasizes that PRI can cover up to 6.2% of FDI in fragile and conflict-affected nations, compared to 3.8% in lower-income countries. PRI generally covers the following kinds of risks: Expropriation (risk/fear that a government may seize foreign assets without adequate compensation), political violence, breach of contract, currency inconvertibility, and regulatory changes. PRI boosts investor confidence by ensuring that possible losses from political events will be reimbursed. This is especially important in India, where political upheavals might result in unexpected policy alterations that harm investments. For example, changes in taxation or environmental legislation might have an impact on profitability, making PRI an important risk management tool. Recent studies show that PRI-backed ventures are more likely to progress in high-risk circumstances. For example, the United States International Development Finance Corporation (“DFC”) revealed that PRI-supported projects experienced a large rise in capital mobilization, highlighting the effectiveness of this insurance in attracting private investment. In the Indian setting, the government’s emphasis on renewable energy and sustainable practices has offered opportunities for private equity investors. However, the switch to sustainable energy sources brings new regulatory obstacles, making PRI an important asset in navigating this changing terrain.

However, there are following challenges with regard to the Indian context:

-

One of the key issues facing PRI in India is a lack of investor knowledge and comprehension of its benefits and methods. Many private equity investors are either unaware of PRI or do not fully understand how it might protect their interests from political risks. This lack of awareness may result in underutilization of PRI products, which may otherwise provide as a safety net in a sector plagued by regulatory changes, expropriation threats, and political instability. According to the Multilateral Investment Guarantee Agency (MIGA), PRI covers just a small percentage of investments in low- and lower-middle-income countries, indicating a utilization gap that might be closed by improved education and outreach initiatives.

-

Another issue is the view of PRI as a supplementary risk management technique. Many investors prefer alternative options, such as developing joint ventures with local partners or progressively implementing investment plans, versus purchase PRI. This desire may originate from a view that local collaborations inherently reduce political risks by improving local knowledge and influence. However, this method can be risky, especially in the oil and gas sector, where the stakes are enormous and political instability can have serious effects. The reliance on local partnerships may not provide significant protection against expropriation or rapid governmental changes, therefore PRI is an important concern that is sometimes disregarded.

-

Additionally, the expense of PRI can be a disincentive to investors. While PRI can provide important coverage, the premiums for these policies may be viewed as excessive, particularly for projects in high-risk locations. Investors may assess the cost of insurance against the potential hazards and conclude that self-insuring or using alternative risk management measures is more cost-effective. This issue is especially important in the oil and gas industry, where profit margins are often low and any additional expenditures can have a substantial influence on project feasibility.

-

Finally, there are insufficient robust monitoring and evaluation procedures for PRI in India. Without proper oversight, it can be difficult to evaluate the performance of PRI products and their impact on investment decisions. Investors may be unwilling to use PRI if they believe there is insufficient accountability or transparency in how these products are administered. A lack of evidence on the efficiency of PRI in risk mitigation can further slow its acceptance, since investors may be unclear of the true benefits of obtaining such insurance.

As a result, while Political Risk Insurance has the potential to considerably improve the investment climate in India’s oil and gas sector, a number of problems and limits impede its efficacy. These include a lack of investor awareness, the complexity of the regulatory environment, the impression of PRI as a secondary instrument, high costs, limited coverage, bureaucratic barriers, and insufficient monitoring methods. Addressing these issues is critical to extending the use of PRI and ensuring that it remains a viable risk management tool for private equity investors in the Indian oil and gas sector.

Conclusion

The oil and gas sector in India has long been the backbone of the country’s economy and has seen a monumental shift with increasing private equity firms’ involvement. Although this influx of capital, for sure, has brought new opportunities for growth and innovation, it has also brought about a complex interplay of factors that require careful navigation.

The primary challenge is to ensure that the PE firms, otherwise driven by short-term profit motivation, are aligned with the long-term developmental goals of the Indian oil and gas sector. Added to this, PE firms bring financial acumen and operational expertise into sectors; however, they tend to manage for the maximization of returns, at times contrary to the broader objectives of the energy sector in terms of security and affordability. A symbiotic relationship must be created so that PE investments align with the energy aspirations of the nation while making attractive returns for the investors. Another major challenge is in terms of regulatory regime. The labyrinthine regulatory regime in India—largely mired by delays and inconsistencies owing to excessive red-tapism—may act as a pull-down factor for PE investors. Streamlining the regulation process with greater clarity on fiscal terms and policy stability will be central features needed to provide a conducive environment for investment. The government can play a big role in facilitating partnerships between PE firms and PSUs to leverage the strengths of both and move the sector development at an accelerated pace.

Also, geopolitics and geopolitical tensions bring in fluctuations in oil prices, thus also bringing in risk to the sector of oil and gas. This calls for a strong risk management strategy on the part of PE firms. Investment can be diversified through various segments of the value chain—upstream, midstream, and downstream—to reduce the risks from price volatility and geopolitical events.

Technological changes open a set of opportunities and challenges. While all these emerging technologies, such as artificial intelligence, machine learning, and digitalization, cut costs and bring about efficiency gains, they call for huge investments in research and development. PE firms need to be prepared to lend support to technological innovation by collaborating with players to stay ahead of the curve. Increased attention has now been directed at the ESG agenda from the oil and gas industry. The latter has to be seen to demonstrate sustainable practices and social responsibility. The investment of the PE firms in clean energy projects with low emissions of carbon and ensuring the well-being of host communities could boost their reputation and attract ESG-conscious investors.

In a nutshell, the Indian oil and gas space is a very complex, multifaceted role for private equity. Overcoming regulatory challenges, alignment with the nation’s energy goals, management of geopolitical risks, embracement of technological advancement, and putting into consideration the ESG is on a front burner that should see PE firms grow and develop into strategic partners in the growth and development of this sector. Collaboration between governments, industry players, and PE firms is absolutely mandatory for unlocking the real potential in this dynamic sector. From here on out, the private equity investment path will be closely conjoined with the future of the Indian oil and gas sector. From negotiating through several issues and capturing the right opportunities, PE firms can play a decisive role in shaping the energy landscape of the country.

Authors:

Prince Awana is an Associate at LexStart Partners (Transactions team) where his focus lies in advising and structuring deals for startups as well as investment funds.

Abeer Tiwari is a first-year LL.M student (Business, Trade and Energy Laws) from Savitribai Phule Pune University.

Disclaimer:

The views expressed by the authors are personal.

Editorial Team:

Managing Editor: Naman Anand

Editor in Chief: Abeer Tiwari and Harshita Tyagi

Senior Editor: Naman Anand

Associate Editor:

Abeer Tiwari

Junior Editor: Sarthak Kumar Ambastha

Recent Comments