Abstract

With India experiencing a wave in which wiser investors are being more cautious of how and where their money is being used, the need for ESG is becoming more evident. This awareness among the new-age investors compels businesses to be more responsible and accountable in terms of environmental, social, and governance aspects, which calls for ESG Reporting.

Additionally, with developing and emerging economies such as India being signatories to UN initiatives such as the Sustainable Development Goals, the private sector of the country ought to focus on lasting and sustainable solutions through their businesses.

Through this Blog, the Authors aim to analyse the need for and the adaptability to the ESG investing and sustainability reporting trends in India. The Blog firstly discusses the concept of ESG on a rudimentary level. It delves into its growing prominence across the globe before shedding light on the local perspective. Further, it seeks to analyse ESG through the lens of the legal framework, regulatory environment, newer formats such as the BRSR and ratings. Lastly, upon deliberation of this practice in light of international standards such as the SDGs, a conclusion is drawn by highlighting the bottlenecks faced with the implementation of ESG.

Introduction

What is ESG?

ESG is an acronym that stands for Environmental, Social, and Governance. These non-financial aspects are increasingly being used by investors in their analytical process to identify major dangers and growth prospects. Companies are now disclosing ESG measures in their annual reports or as part of a standalone sustainability report, which are not often part of obligatory financial reporting.

Source:CFA Institute

ESG looks beyond the typical financial statements and tries to evaluate a company’s impact on its various stakeholders such as employees, customers and the communities in which it operates, ascertaining the current and future risks and opportunities that arise due to its interactions with these stakeholders. To tackle this multifaceted and evolving area, it is helpful to examine the three parts of the acronym.

Generally, “E” or environmental aspects tend to get highlighted the most as they are global in nature and affect every human being regardless of where one resides or operates. In a report from 2020, theWorld Economic Forum estimated that global economic loss from natural catastrophes in 2018 was roughly $165 billion, with 50% of the entire financial effect being uninsured.Climate change is expected to cost more than $1 trillion in the foreseeable future, according to more than 200 of the world’s major corporations. As seen by recent floods in Germany, cyclones on India’s west coast, and fires in Australia and the United States, climate change is a fact. Extreme weather occurrences are affecting people all around the world.

Firms not only influence climate change through their emissions of greenhouse gases but also set off a series of reactions from the natural environment, as well as from other stakeholders such as investors, suppliers, customers, employees, regulators, and communities in which they operate, that can impact their bottom line.

Beyond the immediate physical risk of climate change, which is more severe and less obvious, there is also what is known as transition risk. In our collective efforts to mitigate these physical risks of climate change, governments, customers, communities, suppliers, and competitors are simultaneously transitioning to newer technologies and methods, which could alter the revenues costs or the efficiency of firms grappling with climate risk.

Some argue that prioritising “S” or social elements in sustainable investing ensures that the companies in a portfolio represent an investor’s ideals and moral standards. However, while assessing a company’s social impact, the aspect of profit production is also taken into account. Simply put, financial markets will favour companies that limit their exposure to social issues such as selling unpopular items, sourcing materials from geopolitical hotspots, and employing an unreliable workforce, all of which can affect profits and increase volatility.

The Covid-19 pandemic’s first wave and the migrant workers’ crisis underscored the labour rights issues that India faces. In the past few years, the Union Government has been pushing for labour codes with staunch opposition from trade unions and challenges from state governments.

Historically, in relation to “G” or governance, the relationship between shareholders’ financial interests and managerial self-interest has been the major focus of governance. But the definition of governance is now expanding also to focus on the governance of relations with a broader set of external stakeholders, including governmental and non-governmental organisations. Governance has been the most understood and regulated aspect of ESG. Major corporate scandals from Enron to Facebook had lenient corporate governance issues at their core.

Why is Sustainability Reporting Gaining Prominence?

For a long time, annual financial reporting has been the standard for evaluating investment opportunities and communicating with shareholders. However, investor and other stakeholder expectations are shifting. Stakeholders now expect a level of transparency from companies that goes beyond their financial disclosures. Sustainability is quickly becoming a top issue for corporations around the world, as it is tied to their corporate branding strategy as well as shareholder expectations. Organizations today are expected to be more than profit-driven, revenue-generating machines.

As a result of stakeholder demand, companies have begun to prepare sustainability reports that include environmental, social, and governance (ESG) measurements as part of non-financial performance criteria. While the Indian government does not require all companies to produce these reports, the top 1000 listed companies are required to meet the Business Responsibility and Sustainability Reporting (BRSR) standards. For the rest, it is strongly encouraged because such monitoring and accountability provide information to investors and other stakeholders about the company’s responsible business practises.

ESG: A Local Perspective

To talk of India’s involvement in this, it is warming up towards ESG disclosure with the BRSR standards being rolled out for listed companies. However, initial hiccups in incorporating and streamlining this reporting regime might place undue pressure on companies. Due to the mandatory disclosure of the environmental, social, and governance of businesses, many businesses now find it difficult to raise funds, acquire and retain talent while performing well in the stock market. The stakeholders are becoming more cautious of the repercussions of their investments. The workforce in the market prefer working in a more employee-friendly environment than a purely profit-motivated business; creditors like banks prefer lending loans to businesses with a high standard of ethics than to a business with a high gross profit margin; and investors prefer investing in companies with greater sustainability as intangibles such as ethical and moral considerations have a long-lasting impact on the goodwill of a company. Therefore, those stakeholders who prioritise the longevity and growth of a business over survival would make rational decisions after considering the ESG ratings of these businesses.

While companies like Infosys have voluntarily pledged to carbon neutrality way back in 2011, the mandatory reporting has acted as a wake-up call to many other firms to shift to more sustainable business practices. Over time,around 62 companies have pledged to carbon neutrality. The IRCTC, TCS, and SBI have pledged to achieve net-zero goals by 2030. Although the BRSR format may have come as a shocker to many companies, it could not have been passed at a better time than this. The country ranks at120 out of 193 countries in its sustainability rating.In early August 2021, a new UN Intergovernmental Panel on Climate Change report issued a “code red” warning that, if business as usual continues, catastrophic weather events in India and South Asia will become increasingly prevalent. Ergo, those businesses that indulge in malpractices, exploit resources, and are not responsive to stakeholder interests may find it very hard to adapt to the new BRSR format of ESG reporting. Still, these businesses need to opt for sustainable business practices to avoid long-term repercussions such as those mentioned above.

ESG Investing

ESG investing is a catch-all word for investments with a favourable return on investment and a long-term influence on the environment, society, and business success.

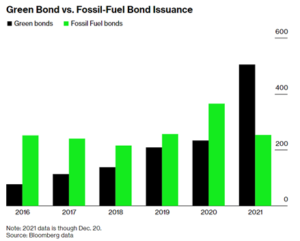

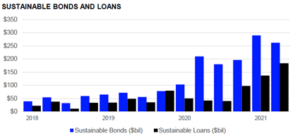

As per Bloomberg, ESG assets may hit US$53tn by 2025, a third of global AUM. Sustainable finance bonds totalled US$552bn during the first half of 2021, an all-time first-half record, while sustainable lending totalled US$321bn during the same period, more than tripling on a year-on-year basis.

Many worldwide fund managers use ESG indices like the S&P 500 ESG Index, S&P Europe 350 ESG Index, and others to make investment decisions. Both active and passive fund managers are increasingly interested in ESG investments. Active fund managers use ESG scores to develop trading strategies, whilst passive fund managers track an ESG index.

ESG investing strategies range from a simple exclusionary screen based on norms or values (exclusions-based screening) to an ESG integration process, which incorporates ESG variables into the fundamental cash flow analysis or security selection.

ESG investing is becoming more popular for a variety of reasons, the most important of which is that investors are realising that ESG factors such as climate change have a genuine long-term influence on the value of their investments.

Companies are increasingly deriving their value from intangible assets such as their employees, use of natural capital, and reputation, which are not recorded in their balance sheets. As a result, analysts would benefit from examining the non-financial data recorded by ESG factors, not only to better their fundamental research but also to assess organisations on risk dimensions. Companies with bad governance or that ignore environmental and social implications are unlikely to succeed in the long run. ESG concerns are not taken into account by funds as part of their fiduciary responsibility to investors.

Globally, the percentage of retail and institutional investors that apply ESG principles to a quarter or more of their portfolios jumped from 48% in 2017 to 75% in 2019.

The ESG profile is also connected to long-term financial performance, and shareholders remain crucial when assessing stakeholder objectives. In 2020, ESG-focused mutual funds outperformed the S&P500.

Source:Refinitiv

ESG Investing in India

ESG investing in India has been steadily gaining momentum in the last five years, but efforts are still nascent.

As of June, India’s ESG AUM stood at $1.5 billion, accounting for 2% of Asia-Pacific ESG funds AUM, according to EPFR data. This compares with India’s share of 10% in overall APAC AUM. The number of sustainability funds in India also accounts for only 2% of the Asia Pacific total, trailing most other Asia Pacific regions in 2021.

Investment trends indicate a rising interest led by institutional investors, which have provided capital from both equity and debt issuances where ESG is the main consideration. Green bonds, the most widely leveraged bond instrument in the ESG space, has seen increasing issuances, mainly by power generation companies and banking institutions.

There have been multiple deals in the equity space where a variety of capital providers ranging from SWF’s, PE’s, oil & gas majors and business conglomerates have invested in the equity of companies ranking high on ESG parameters. On the list of sovereign entities are ENEL, CDPQ and Canada Pension Plan Investment Board (CPPIB), the largest global pension fund, as are GIC, Temasek, IFC, CDC, National Investment and Infrastructure Fund (NIIF) and, more recently, Norfund. Major investment has come from almost all the global PE players, among them Goldman Sachs, KKR, Global Infrastructure Partners (GIP), Actis, Morgan Stanley, ADIA and JP Morgan. A third set of investors (some of them more recent) includes oil and gas majors such as Total SE, Shell, Petronas and Malaysian and Thai fossil-fuel companies for which renewables provide a sustainable hedging solution as the world tries to go greener. Further investment has come from the national conglomerate majors like Adani, Tata and most recently Reliance Industries.

Until 2019, there were only a couple of mutual fund ESG schemes. In 2020, India’s largest asset management companies like Aditya Birla Sun Life, Axis Mutual Fund and ICICI Prudential launched such schemes too. Many Indian blue-chips are sharpening focus on the ESG aspect, which may reflect in their balance sheets in the long run, maybe in terms of reduced operational costs. But for now, it is difficult to say if their good intentions will reflect in valuations.

ESG mutual funds offer investment avenues for retail investors, though they account for a tiny portion of the total industry at 0.3% of the total AUM. This could change with improvement in ESG disclosures and a renewed focus on governance reforms.

Other instruments such as ETFs and InvITs also offer ways to increase exposure to ESG for both institutional and retail investors.

Functioning of ESG Reporting

ESG Ratings

An ESG rating assesses a company’s long-term exposure to environmental, social, and governance risks. Investors that utilise ESG ratings to enhance financial analyses might receive a broader view of a company’s long-term potential, as ESG problems are often overlooked during traditional financial reviews.

Each ESG grade identifies key issues per industry. While packaging materials and trash are important challenges in the soft drink sector, they are not as important in companies that do not physically package their products or services, such as technology or infrastructure.

The importance of issues is determined by their timeliness and possible impact. The issues with the greatest weights are those that could have a significant environmental or societal impact in the next two years. In an industrial context, for example, worker safety poses an immediate threat with serious financial and legal ramifications.

Various agencies such as S&P, Moody’s, and Fitch, along with companies such as Bloomberg, MSCI, Refinitiv, provide ESG scores for debt and equity of listed and unlisted companies.

ESG Standards and Frameworks

A rising number of organisations have established ESG standards as more corporations strive to report on their environmental and social consequences. There are now over a dozen primary ESG reporting frameworks, each with its own set of measurements, methodology, and score system.

With ESG standards, all stakeholders can correctly determine a company’s sustainability efforts and not be drowned under a company’s false claims of a green persona.

These reporting frameworks serve as the foundation for how firms set KPIs, monitor performance, and compile sustainability reports.

Carbon Disclosure Project (CDP), Climate Disclosure Standards Board (CDSB), Global Reporting Initiative (GRI), International Integrated Reporting Council (IIRC), Sustainability Accounting Standards Board (SASB), and Task Force on Climate-Related Financial Disclosures (TCFD) are the top ESG reporting standards.

Source:Responsible Impact Group

Standards help report an organisation’s impacts in a credible way that is comparable over time and in relation to other organisations. It enables stakeholders and other information users to understand what is expected from an organisation to report on and use the information published by organisations in various ways.

Companies can align with multiple standards by referencing common metrics or KPI’s between standards.

Regulatory Environment for ESG Reporting

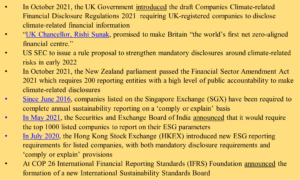

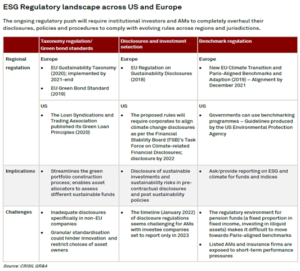

Mandatory environmental, social, and governance (ESG) disclosures have already become a reality. Starting in 2023, the EU’s new Corporate Sustainability Reporting Directive would triple the scope of firms and enhance the necessary substance of non-financial reporting. Just before COP26, the UK announced that, by 2025, the TCFD-recommended environmental disclosures, which will soon apply to certain UK-listed firms, will be mandatory for the entire economy. It also revealed its work on its own ‘green taxonomy’ of sustainable activities at the same time. The US Securities and Exchange Commission, as well as some Asian, Middle Eastern, and North African authorities, are moving in the same direction. The following are a few examples of this.

Source: Author Analysis

Analysing the Shift from BRR to BRSR

The Securities Exchange Board of India (SEBI), in its board meeting in 2021, introduced the BRSR format replacing the existing Business Responsibility Reporting (BRR) format. This format must be mandatorily implemented across the top 1000 listed companies from the upcoming financial year 2022-23. Rudimentarily speaking, the need for the BRSR format can be traced back to the enactment of the National Guidelines for Responsible Business Conduct 2019.

In 2019, the SEBI along with the Ministry of Corporate Affairs, decided that there was a need for all the top 1000 listed companies to follow mandatory guidelines for business responsibility and sustainability reporting and evolve from the National Voluntary Guidelines. This was passed in light of the UN Global Compact, UN Sustainable Development Goals and an overall outlook of the businesses functioning globally. The same was also opined in the World Economic Forum, where it was found that the success of businesses lies in their stakeholder interests.

As the world moves towards becoming a more sustainable and socially responsible place, it is only fair for businesses also to implement sustainable practices for their long-term success. The Committee on Business Responsibility Reporting proposed that the BRR be renamed the Business Responsibility and Sustainability Report to better reflect the aim and scope of the reporting requirement (BRSR). The change in terminology denotes the wide scope of reporting. The Committee made every effort to make the BRSR reporting format a single source for all non-financial disclosures. Global public policy has been going in this way over the past two decades.

In terms of formatting modifications, the BRSR framework, unlike the SEBI-mandated structure for BRR disclosure in annual reports, concentrates on the most important and desired aspects of sustainability and responsibility reporting. The BRSR formats were created to provide a unified source of sustainability data reporting for businesses across the country.

The BRSR format consists of three essential sections: a. General disclosures b. Management and process, and lastly, c. Principle-wise performance.

The SDG Perspective

BRSR standards culminate the SDGs, NGRBC, GRI, and UNGPs. The BRSR is based on nine fundamental principles that provide the bedrock for this format. However, three out of these nine principles can trace its origin to the SDGs in specific. These have been elaborated below.

Principle 1 –Businesses should conduct and govern themselves with integrity and in a manner that is ethical, transparent, and accountable: SDG 17, Partnerships for Goals, is the foundation for this principle. Employees, workers, senior management, the board of directors, and other key managerial individuals are examples of internal stakeholders, whereas investors, consumers, suppliers, and other value chain partners are examples of external stakeholders. A business’s compliance with the concept can be ensured if the individuals associated with the business follow it jointly and severally. Conducting training and awareness programmes for stakeholders becomes critical in this situation. An organization’s core job is to train and educate employees, workers, board members, and others, and information is sought under the “essential” qualities, whilst programmes for other value chain partners are a sign of the entity’s “leadership” traits.

Principle 2 –Businesses should provide goods and services in a manner that is sustainable and safe: According to SDG 12, sustainable production and consumption are intertwined, contributing to improved quality of life and the protection and preservation of the earth’s natural resources.

Principle 3 –Businesses should respect the interests of and be responsive to all their stakeholders: The identification of stakeholders is the most critical step toward achieving this objective. Organizations must also identify their stakeholders, particularly those who are disadvantaged, marginalised, or vulnerable, according to the UNGPs. Stakeholders in every organisation come from a variety of backgrounds, including economic, social, and environmental concerns. While a company may not be able to respond to all of its stakeholders 100% of the time, it must identify its most important stakeholders. Other principles can be linked to such recommendations in the same way.

Challenges in Sustainability Reporting: Concluding Remarks

While ESG reporting seems like the need of the hour, it may have operational bottlenecks. One such bottleneck is the lack of standardisation. Unlike financial metrics, ESG reporting being a non-financial report, does not follow a universal style of reporting. This means that one report can be interpreted in several ways. This bottleneck must be overcome by establishing a standardised format for the reporting of ESG. A standardised format would also ease the process of conducting a comparative study across sectors and businesses while making investment decisions. Considering all this, BRSR seems to be a more apt style of formatting as it includes 1000 listed companies to mandatorily disclose relevant details that would aid in decision making. Indeed, the implementation of ESG and sustainability reporting is indispensable, albeit the minor practical difficulties.

Furthermore, absent new legislation or investor pressure, corporations are unlikely to adjust their reporting procedures. This is demonstrated by the fact that countries with mandatory reporting requirements or a significant regulatory push from the government (such as the United Kingdom and France) do better than countries with little or no regulatory drive.

While regulatory pressure is important, a lack of investor pressure might stifle the movement toward more public disclosures. Concerns have been expressed by businesses about the lack of investor interest in climate change issues.

Another issue that businesses confront is the lack of clarity in regulators’ advice texts. Regulations and guidance materials fail to ask for information that must be supplied in a timely manner.

Furthermore, there is a disconnect between investor expectations and facts supplied by corporations. Because ESG performance data is mostly self-reported, larger organisations with more resources for ESG reporting may bias the results.

Going forward, as global best practices in sustainability reporting emerge, along with consensus around the particulars for reporting and universal acceptance of the definition of materiality for every sector, the guiding documents by regulators will also be better deciphered by companies and investors alike. In India, the institutional investor community is slowly but steadily realising the importance of ESG. Moreover, shareholder activism on ESG issues has been growing in the country.

Further, understanding ESG risks and opportunities will enable the linking of ESG strategy with the overall strategy. Companies will be in better shape to recognise, measure and report on ESG metrics. A key deliverable for companies will be to keep learning from industry peers who are leading in terms of ESG reporting and continue imbibing the culture of linking the non-financial and financial aspects of business together.

Disclaimer

Views are personal and do not necessarily reflect the views and opinions of IEEFA. The blog is for information and educational purposes only.

About the Authors

Mr. Shantanu Srivastava is CFA, Energy Finance Analyst at Institute of Energy Economics and Financial Analysis (IEEFA), New Delhi.

Charvi Devprakash is a 3rd Year Law Student from PES University, Bengaluru, and an Associate Editor at IJPIEL.

Editorial Team

Managing Editor: Naman Anand

Editors-in-Chief: Jhalak Srivastav and Aakaansha Arya

Senior Editor: Hamna Viriyam

Associate Editor: Charvi Devprakash

Junior Editor: Harshita Tyagi

Preferred Method of Citation

Shantanu Srivastava and Charvi Devprakash, “ESG Investing and Sustainability Reporting Trends in India” (IJPIEL, 4 March 2022)

<https://ijpiel.com/index.php/2022/02/28/a-three-way-critique-of-impact-of-concession-agreements-in-the-indian-infrastructure-sector-from-a-competition-law-ports-sector-and-gst-perspective/>

Recent Comments